Picking Your Spots in Fixed Income

Deron T. McCoy, CFA®, CFP®, CAIA®, AIF®

Chief Investment Officer

Let’s be honest, bonds can be rather boring. In a best-case scenario, they pay a coupon and then repay principal at maturity. But as analysts, we get excited when we get into the weeds. We believe that even the perceived humdrum fixed income asset class is exciting when we start to differentiate the different types of bonds.

The largest amount of bonds outstanding are those tied to the U.S. government. These come in a variety of maturities (from 3 months to 30 years); there’s even some talk of issuing 50-year or 100-year debt given current low rates. Three-month Treasury Bills (or T-bills as they are known) carry the least risk since it’s highly unlikely that the U.S. government will default in the coming quarter. Additionally, inflation likely won’t erode the purchasing power of your investment over the next 90 days. Because of their safety, however, T-bills only yield around 1.75% currently.

Every other type of bond carries some modicum of risk. And if we want to earn more than 1.75%[1], then as investors we must decide which risks to take.

LONG-TERM TREASURIES

Risk comes in many forms – and even a United States Treasury Bond will carry risk–especially if it has a 30-year maturity. Sure, over the next thirty years a default by the U.S government is remote. But with current 30-year bonds yielding around 2.30%[1], there’s a significant risk that future inflation could erode future returns. Consider the repayment of principal in 30 years. If inflation averages around 2% annually, your investment would barely break even. Additionally, the bond is subject to “interest rate risk.” If interest rates were to move higher during the life of the bond, the opportunity cost could be significant. In fact, if rates were to move up to 5% in 10 years, your 30-year Treasury would lose about 40% in principal and you would have to wait perhaps another 20 years to recoup those losses by holding it to maturity.

Opposite to prior cycles in previous decades, in this era interest rate risk may not be the best risk for bond investors as the reward is meager. Fortunately, investors can take other risks by owning bonds that are tied to other assets and risks unrelated to the U.S. government and unrelated to 30-year maturities—such as corporations and real estate. So, let’s look more closely at those two.

CORPORATES – INVESTMENT GRADE

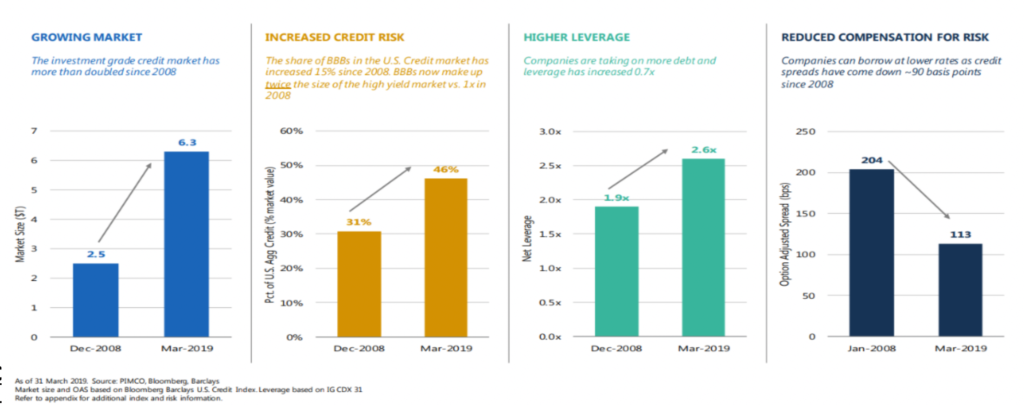

Most consider Investment Grade (IG) bonds to be relatively safe within the fixed income world. Consider, however, that the size of the IG universe has more than doubled since 2008. Ten years into an economic cycle, companies are taking on more debt and increasing leverage ratios. The lowest rung of the investment grade universe (bonds that are rated BBB) now make up nearly half of the IG universe—up from 38% in 2009 according to the Wall Street Journal[2]. In fact, as recently as October 22nd, the WSJ stated that the ratings agencies are enabling corporations to borrow more money by no longer downgrading bonds into junk territory at the same rate as they did in prior periods. As a result, the BBB rating has exploded over the past decade, with debt outstanding more than tripling to $3.7 trillion.

Complicating the situation is that amidst this huge supply, the demand (owners) now resides in daily liquid investment vehicles such as mutual funds and exchange traded funds. In the past, this debt would be held by more stable owners. But given current rules and regulations affecting their balance sheets, banks and dealers aren’t holding these bonds in inventory as U.S. Dealer inventories have dropped from $250 billion to under $50 billion this cycle. If retail investors all hit ‘sell’ at the same time, the whoosh lower could be dramatic.

What do investors get for all this risk? Unfortunately, surprisingly low yields! The spread between BBB bonds and those tied to the U.S. government shrank to 1.49% on 10/22[3] – not much comfort when a crisis hits or should the economy slow. Wise investors know they should expect decent returns for decent risk, but the current paradigm in IG corporate bonds isn’t set up that way.

The Changing Corporate Bond Market

CORPORATES – NON-INVESTMENT GRADE (High Yield, Bank Loans, Private Credit-Direct Lending)

It only gets worse when investors analyze the non-investment grade sector of the corporate bond market. Bottom rung companies must issue debt either in the High Yield market or in the Bank Loan market – markets which have not only more than doubled in size since the last crisis but also now comes with higher leverage ratios as well.

In fact, once a niche business, private bank loans to middle market companies is now a $900 billion asset class; similar in size to what the high yield market was pre-crisis (as a side note, the entire subprime market was $1.3 trillion in 2008[4]). These loans have typically been issued with covenants that protect the investor in times of crisis (Covenants are agreements between the investor-lender and the borrower that protects the former from corporate malfeasance—as a loan investor you wouldn’t want a private company to pay a massive dividend to equity owners just ahead of a bankruptcy—rather, you would want that money to be retained for loan holders in case of default). But in recent years, though, these loan protections are being stripped away. Years ago, maybe only $100 billion of these private deals would be issued without covenants (known as “cov-light”) but today there’s more than $1 trillion worth of private bank loans without investors protections. Not all middle-market lenders are chasing yield and foregoing covenants, but to those that are we would say, “High leverage, no dealer middleman, no protections? No thanks.”

DON’T FIGHT THE LAST WAR

If we strip out interest rate risk and corporate credit risk, what other risks are investors left with? Well in short, it leaves risks that are tied to the last recession. And in a strange twist, these risks are the most attractive. Why? As a rule of thumb, what usually causes the last recession doesn’t cause the next one. The savings and loans crisis didn’t cause emerging market currency crisis which didn’t cause the dotcom bubble which didn’t cause the real estate/mortgage/banking crisis. Why is this so? Because government officials ringfence the problem in an effort to lessen the likelihood it doesn’t happen again and skittish investors are certain to not commit the same mistake twice. The result is excessive rules and regulations amid a dearth of investment activity which curtails excessive leverage—the real culprit to most bear markets. As a result, the major causes of the last recession look attractive today.

MORTGAGES

Bonds tied to real estate are commonly known as mortgages. Mortgages can be tied to large commercial skyscrapers or development projects or they can be tied to residential housing—and these residential mortgages can further be subdivided into conventional loans issued to prime borrowers by government agencies (Fannie Mae, Freddie Mac, Ginnie Mae etc.), or higher-risk mortgages issues to those with less than stellar credit. Those latter bonds may sound familiar as “subprime” mortgages took center stage in the press as a potential catalyst for the 2008 financial crisis.

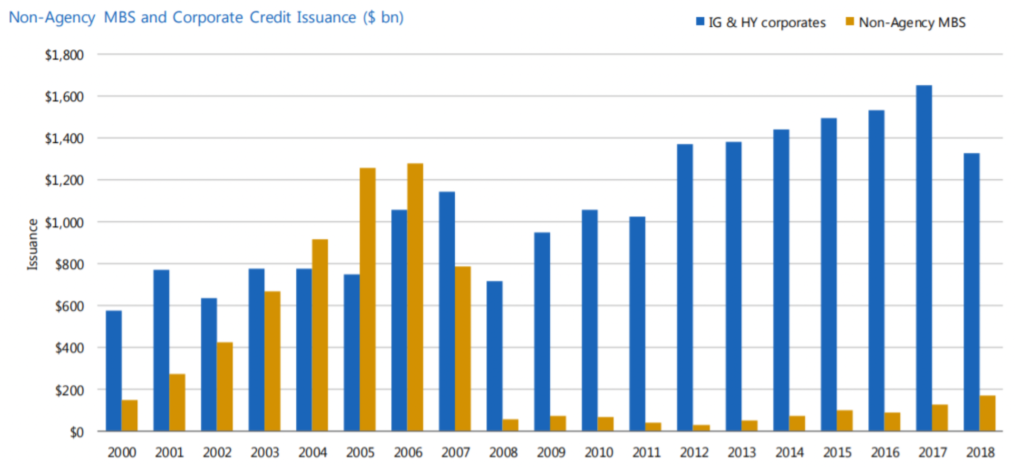

But fast forward to today. The subprime debt (now called Housing High Yield around the Investment Committee) that still exists is now 11-15 years old. If the borrower has not defaulted by now, the likelihood of them defaulting in the future seems slim. Consider too that the borrower now has 11-15 years of wage gains (putting them in a better financial position to improving interest coverage ratios) and 11-15 years of price appreciation in their home (improving collateral). And investor protections and the rule of law (remember covenants?) still exist as lenders still have the right to foreclose and take back the home. Furthermore, borrowers (in contrast to corporations) aren’t as heavily leveraged as they once were (see Figure: “The Changing Corporate Bond Market”). Additionally, while credit issuance continues to accelerate in the corporate space, the issuance of “non-agency” bonds is very low, representing an attractive supply-demand imbalance (Figure: “Supply Dynamics: Corporate HY vs. Housing HY”). Finally, many of these loans have a floating rate payment structure mitigating interest rate risk should yields move up in the coming years.

In short, the illiquidity and credit risks seem manageable all while providing yields similar to that of the corporate high yield market. Better risk profiles. Similar return profiles in the current setting and much better protections in a downturn. Who said bonds were boring! As analysts, we would suggest investors ‘overweight’ this asset class.

Supply Dynamics: Corporate HY vs. Housing HY

PREFERRED STOCKS

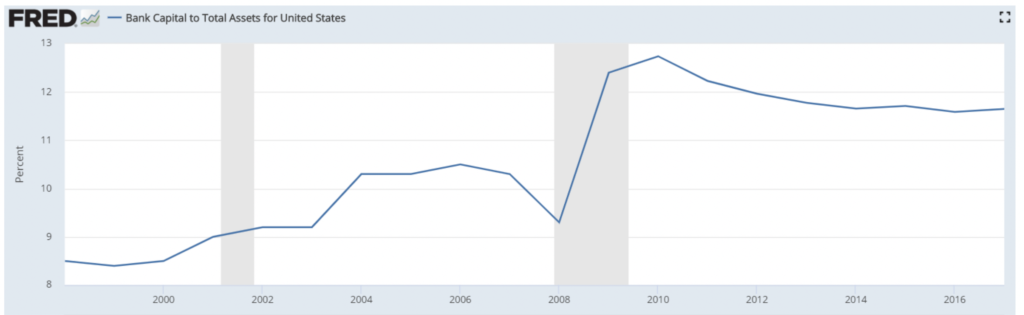

Other assets tied to the last recession include the entities that made the mortgages. Banks, like subprime mortgages, were at the center of the financial crisis. However, due to the intense post-financial crisis regulation of U.S. financial institutions (Dodd-Frank, Basel III, etc.), banks now possess some of the strongest balance sheets in corporate America (see chart below). With this decreased leverage, their default risk is also greatly reduced. Therefore, wise investors may move down the capital structure from senior secured debt to preferred stock to capture additional yield. While many types of companies issue preferred stock, preferred stock issued by banks may be an attractive area at this time. This move down removes some investor protections and potential collateral and certainly may come with an increase in volatility relative to a corporate bond, but in our view the pick-up in yield more than compensates for the increased risk, while at the same time reducing inflation and interest rate risk as well.

Bank Capital to Total Assets for United States

Bank Capital to Total Assets for United States

Source: World Bank

CONCLUSIONS

As of early November, stocks have run up to all-time highs. With valuations relatively high and earnings set to grow mid-to-high single digits, stock price appreciation looks to be more tepid than the last several years. If we can generate similar returns from bonds, then a balanced approach seems prudent. But like stocks carry risk—so do bonds. And all bonds apart from Treasury bills come with different risks. Given where we are in the current economic cycle, however, bond investors would be well-advised to steer clear of certain risks while embracing others.

[1] Treasury.gov

[2] Wall St Journal

[3] https://fred.stlouisfed.org/series/BAMLC0A4CBBB

[4] NBC News: Will subprime mess ripple through economy?

Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc. ID#102919 – 9109544 – 17683195

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.