Smart Beta 101

By Sam Miller, CFA®, CFP®, CAIA®

Senior Investment Strategist

Over the last decade, smart beta has continued to emerge as an increasingly popular investment style, for both institutional investors and wealth management firms alike. Asset flows have matched this increasing enthusiasm with smart beta ETFs reaching $1.3 trillion in AUM as of July 31st, 2021, according to Morningstar[1] The assets in this category are spread across hundreds of different investment vehicles, ranging from simple single-factor strategies to multi-factor approaches with more complex quantitative engines driving asset allocation. Consistent with many “hot” trends in the investment industry, there is little consistency of definitions and naming conventions in the early stages, resulting in the potential for confusion for the end investor. In the paragraphs that follow, we will sort through the noise to clarify what smart beta is and why it might make sense for you.

What is smart beta?

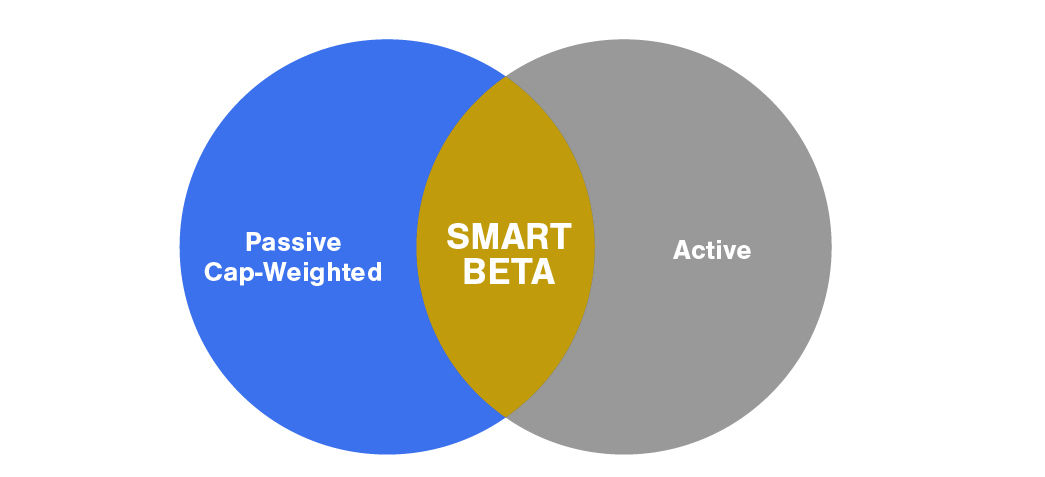

Also referred to as strategic beta, fundamental indexing, factor investing, and more, smart beta is a term that refers to investment strategies that attempt to deliver better risk-adjusted returns or superior diversification than traditional market-cap-weighted indexes by using a quantitative methodology to capture specific investment factors.

For decades, active portfolio managers have engaged in stock picking by searching and finding stocks with attractive characteristics. With the improvements in computing power and data availability, modern day portfolio managers can use advanced analytics to find stocks that possess specific traits more easily than ever before. These scalable methods can be used across entire universes of stocks. Thus, smart beta strategies can recreate a traditional active strategy by replacing the human portfolio manager with a rules-based approach to screen for stocks that have certain attractive characteristics.

According to Research Affiliates, “smart beta strategies are designed to add value by systematically selecting, weighting, and rebalancing portfolio holdings on the basis of characteristics other than market capitalization.” In simpler terms, smart beta combines the benefits of index investing with the benefits of active investing:

- Similarities to index investing

- rules-based methodology

- transparent

- low expected turnover

- Similarities to traditional active investing

- potential for tracking error relative to benchmark

- potential for outperformance (higher return and/or lower risk)

- potential for underperformance relative to a traditional benchmark

A traditional stock index is capitalization-weighted, meaning that a company’s share of the index depends in part on the price of its common stock. If the market price of a stock rises, so does its weight as a percent of the total index, and vice versa. As a result, the traditional index systematically (and counterintuitively) buys more of the stocks that may be overvalued and less of the stocks that may be undervalued. Smart beta seeks to improve on this methodology by identifying and allocating to specific factors that have been proven to compensate investors for taking risk historically and are expected to continue to compensate investors going forward.

Figure 1: Smart beta blends passive and active approaches

History of Smart Beta

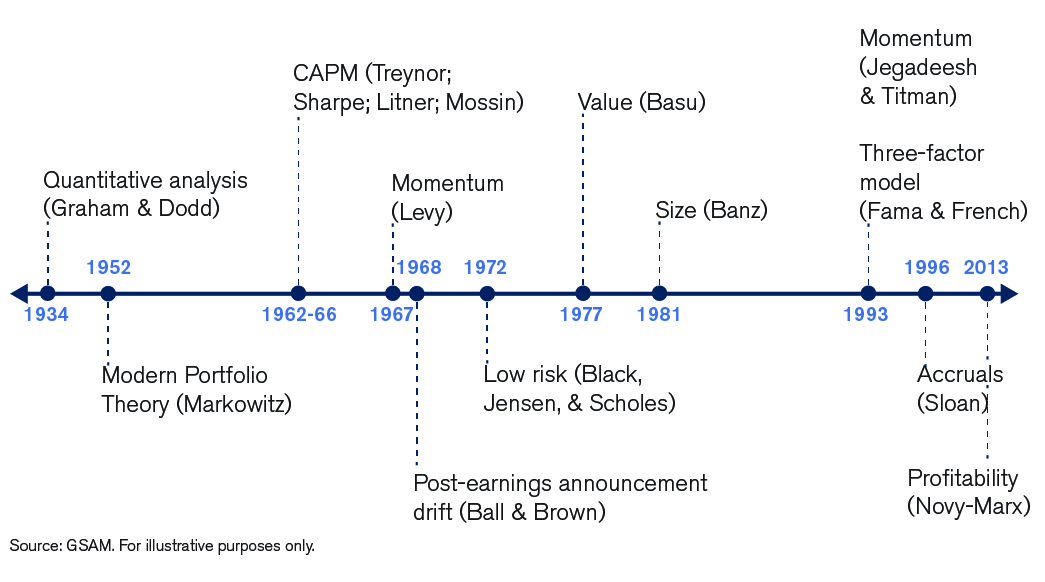

We generally advocate running the opposite direction from Wall St’s hot new trendy investment product, or at least proceeding with extreme caution. However, while smart beta strategies have caught on with the wealth management community in recent years, institutional investors have used alternative weighting and factor-driven strategies since the 1970s. A large body of academic research has advanced the development of smart beta investing over the course of the last 80 years (see Figure 2). This research has withstood the test of time and provides a strong foundation for potential benefits going forward.

Figure 2: A Timeline of Advancement in Smart Beta Investing

What is a factor?

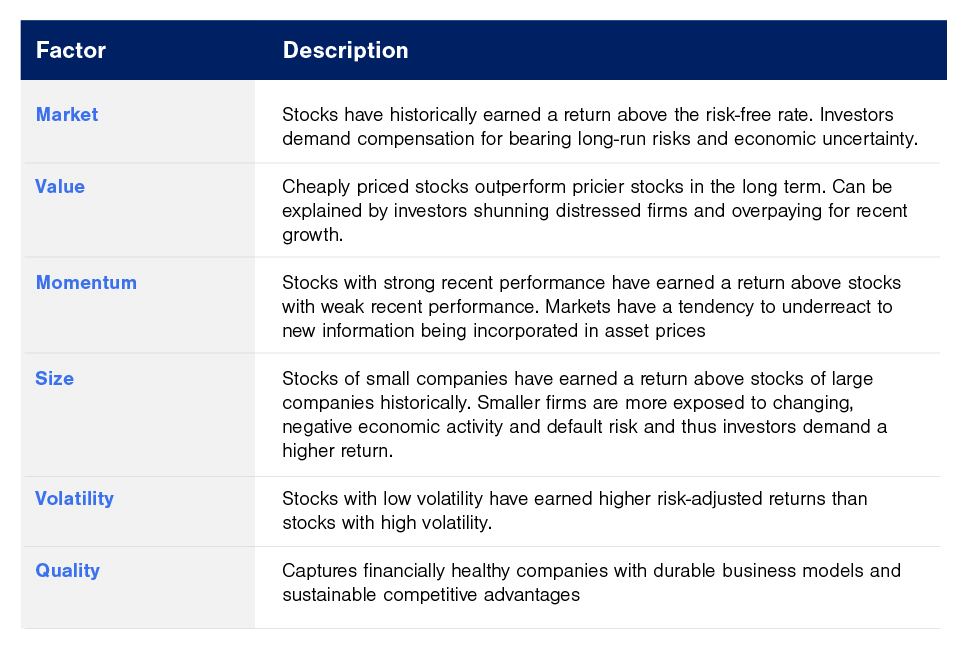

A factor is defined as any characteristic that helps explain an asset’s long-term risk and return performance. These factors include value, size, momentum, volatility, quality, and others.

Figure 3: Factors Described

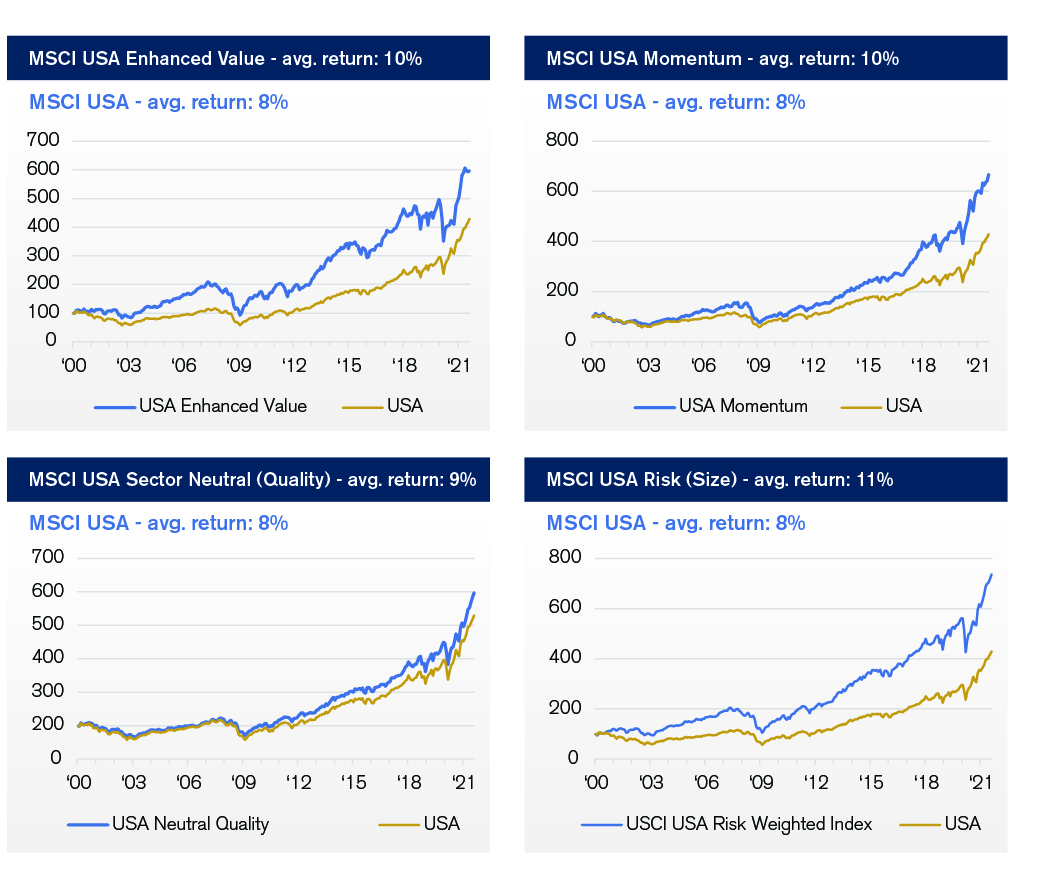

While these factors have enhanced returns (see Figure 4) and can be invested in individually, we advocate a multifactor approach, which we will explore further in a future paper on this topic.

Figure 4: Performance of Factors

By blending attributes of indexing and active strategies, smart beta provides investors with an alternative and potentially superior approach to investing. For a number of economic and behavioral reasons, this targeted approach to factors may provide higher returns for a given level of risk as compared with traditional market cap weighted indexes over the long-term. Investors would be wise to pay attention to this fast-growing investment style and consider incorporating it into their portfolios.

[1]https://www.morningstar.com/articles/1059551/strategic-beta-is-active-management

Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.