Spaced Out from Stock Options

A case study on the opportunities and challenges of SpaceX employee stock option planning

By Eric C. Pritz, CFP®, CMFC®

Partner

Kyle Demshki, CFP®

Advisor

Executive Summary

Employee stock options are a mystical component of the corporate compensation package. Employees are often recruited and rewarded for their hard work with the mighty “E” word; equity. Excitement builds as the value of the company’s stock grows parallel to the success of the organization. Soon enough, employees of many different compensation levels and hiring dates have enough employee stock options to think about accomplishing their goals, such as purchasing a home or retirement. But as the old saying goes, “don’t put all your eggs in one basket.” Case in point, “since the early 1980s, 40% of all companies experienced a severe loss and never recovered.”1 You don’t invest your whole 401(k) into one stock, right? We extend the same philosophy to a client’s entire financial picture. Your employee stock options made you money, but now it is time to preserve your money by taking some gains and investing in other sectors of the market and other asset classes.

Once the employee understands and buys into this strategy, the next step is often overwhelming…how do I begin cashing in on these options? Unfortunately, it is not as easy as pushing a “sell” button. We as financial planners have ample knowledge of the rules and strategies to potentially maximize the after-tax proceeds of these complicated assets. We will further explain in this study how we work specifically with SpaceX clients to complete this objective.

Background

Company Overview

SpaceX is one of today’s most advanced aerospace companies, seeking to design and launch revolutionary spacecrafts that will ultimately enable mankind to colonize other planets. The company was founded in 2002 and currently has over 5,000 employees. 2 The growth of SpaceX relies on the success of its launches to showcase its latest and greatest technology in rockets. In turn, these successes lead to the company being paid in contracts by corporations and governments for delivering payloads into orbit.

Paid in Stock Awards

The 5,000+ SpaceX employees are paid by form of salary plus stock awards. There are several types of stock awards, but the ones we will be focusing on are Restricted Stock Units (RSUs) and Incentivized Stock Options (ISOs). Companies choose this form of compensation because, as the name implies, company stock options incentivize employees to remain with the company and contribute to its success. Thus, goals of the employee and company become aligned. As the company stock price rises, so does the value of the employee’s stock awards.

Restricted Stock Awards

RSUs are a promise from an employer to pay an employee in shares of company stock once certain goals or milestones are reached.3 Once a milestone is reached on the vesting date, the employee officially owns the stock and pays ordinary income tax on the value of the stock on that date. If the employee keeps the stock, any future appreciation in value is reported as capital gains. Then, holding the stock for at least a year will result in more favorable long-term capital gain tax treatment.

Incentivized Stock Options

ISOs are a little more complicated than RSUs. ISOs are the right to purchase a given number of shares of company stock at a specified price (grant price).4 When the employee reaches their vesting date, they are eligible to exercise (purchase) the shares at the grant price. In addition to the cost to purchase the shares, the employee may also have to pay AMT tax on the bargain element (the difference between the value of the stock on the exercise date and the grant value).4 Please consult your accountant for details on your own individual tax situation. To receive favorable long-term capital gain tax treatment upon the eventual sale of the stock, the date of sale must be at least one year after the exercise date and two years after the grant date. If these rules are broken, the bargain element is taxed as ordinary income and the gain above the value of the stock on the exercise date is taxed according to capital gain holding period rules. Your accountant can assist you prior to selling the stock in determining if an AMT tax credit will help offset realized gains from the sale.

What is the Problem?

In a successful company such as SpaceX, employees’ wealth is highly concentrated in company stock as the valuation of the company has skyrocketed over a relatively short period of time. While at first this may not seem problematic, we as financial planners view this as a major risk to a client’s financial goals. One bad day in the company’s history and the value of an employee’s stock holdings could drop substantially. While we have no reason to assume this will happen to SpaceX, we want to prepare for all possible scenarios in an individual’s financial future. On the far end of the spectrum, we look to the cases of Lehman Brothers and Enron whose companies’ futures (along with their employees’ retirement plans) ended in disaster. Outside of these grave circumstances, many companies simply experience high volatility in their stock price over time. When an individual is trying to plan for a home purchase or a specific retirement date, volatility in a company’s stock price brings uncertainty to the picture. The cause of this volatility requires further investigation in the proceeding section.

Unsystematic Risk

Unsystematic risk, also known as company risk, stems from financial uncertainty of a corporation in which one is invested. At any moment in time, a company may face a hardship from its management decisions, industry competitors, or government regulation that causes the stock price to suddenly fall. SpaceX risk factors include potential launch failures, loss of contracts, dependence on one executive (Elon Musk), and competition from other aerospace firms.

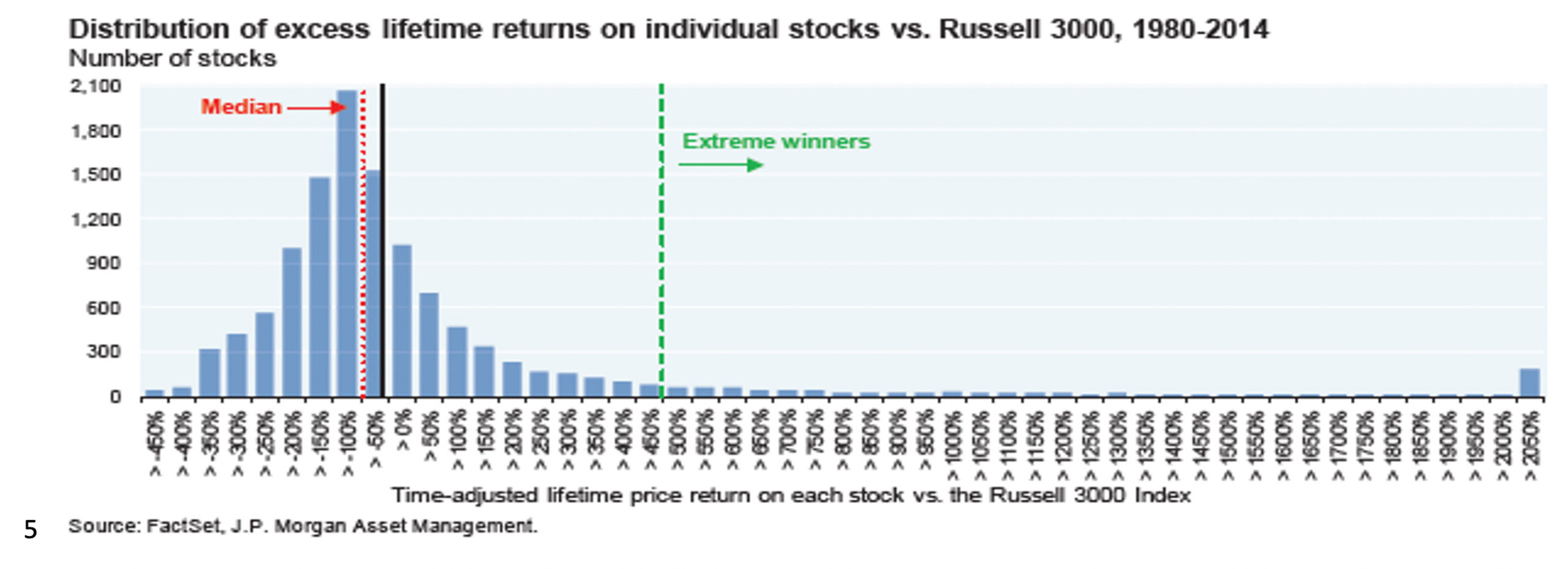

The following chart shows real data on how individual stocks have performed versus the comparable stock market index.

The chart reflects all large cap, mid cap, and small cap stocks that were a member of the Russell 3000 index from 1980-2014, totaling to 13,000 of the largest US companies. As you can see, roughly two-thirds of all individual stocks have underperformed the Russell 3000 Index during this 35-year period.5 Put simply, it is very difficult to predict in advance which companies will be the winners and which will be the losers.

How to Avoid Unsystematic Risk

The method that we as investment managers use to avoid unsystematic risk is diversification. By diversifying the investments in a client’s portfolio in different asset classes, we can potentially reduce this risk. This is even more important for portfolio downside protection, as concentrated stock portfolios tend to suffer more losses in bear markets. Diversified investors outperformed non-diversified investors by as much as 15% during the Great Recession of 2008.6Over the course of an investment lifetime, large events such as these greatly impact an individual’s retirement nest egg.*

*Investing involves risk including the potential loss of principal. No investment strategy can guarantee or protect against loss. Past performance is no guarantee of future results.

Case Studies

We will illustrate two different hypothetical client scenarios below and the financial planning involved to navigate the risks and taxes.

Client A (John)

John received over 45,000 shares of vested (available to exercise/purchase) SpaceX ISOs with grant prices between $7.00 and $42.00 (this is the price to purchase each share). The majority of these ISO’s were at the $7.00 grant price. John also owned vested RSU’s available for sale. John’s goals were to secure his family’s retirement needs should he decide to retire or pursue a passion project in the next 5 years.

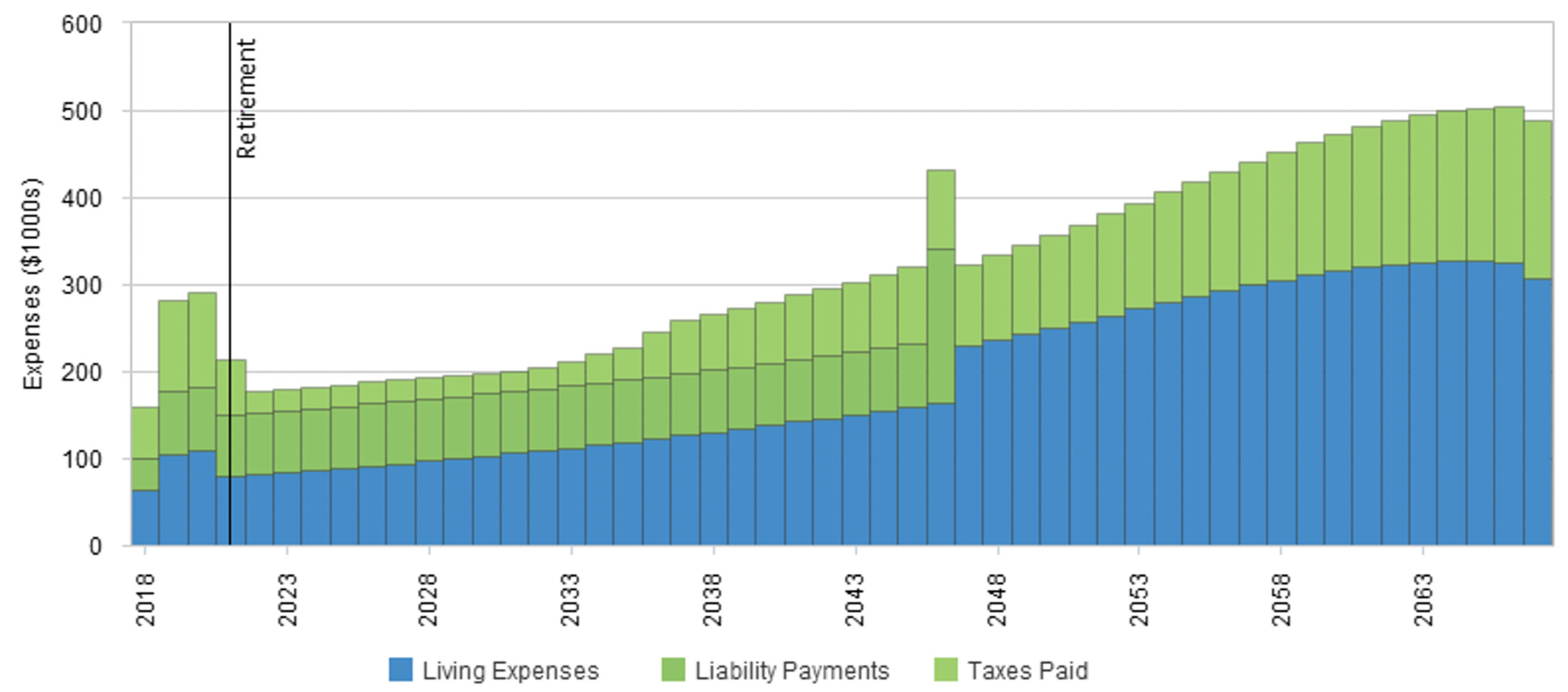

Our first step in the financial planning equation was to determine the total assets needed to conservatively fund all family expenses today and going forward. By looking at assumed cash outflows now and through retirement with inflation included (graph below), we solved for total assets needed (assuming these assets are invested in a diversified portfolio, so we could assume a reliable rate of return based on historical data).

Considering the client’s other assets and retirement investments, we determined we needed to accumulate over $1.5M in diversified after-tax assets to provide for lifetime income and growth to fund retirement cash flow needs.

Game Plan

The only way to access this much liquidity from John’s balance sheet was to unlock the value of around half the $7.00 ISO’s. As John felt relatively confident in the SpaceX stock and willing to hold onto it for a year, we decided to employ the exercise and hold (for 1 year) strategy. This involves exercising (buying) the $7.00 ISO’s and holding for 1 year to eventually sell at preferable Long-Term Capital Gains taxes.

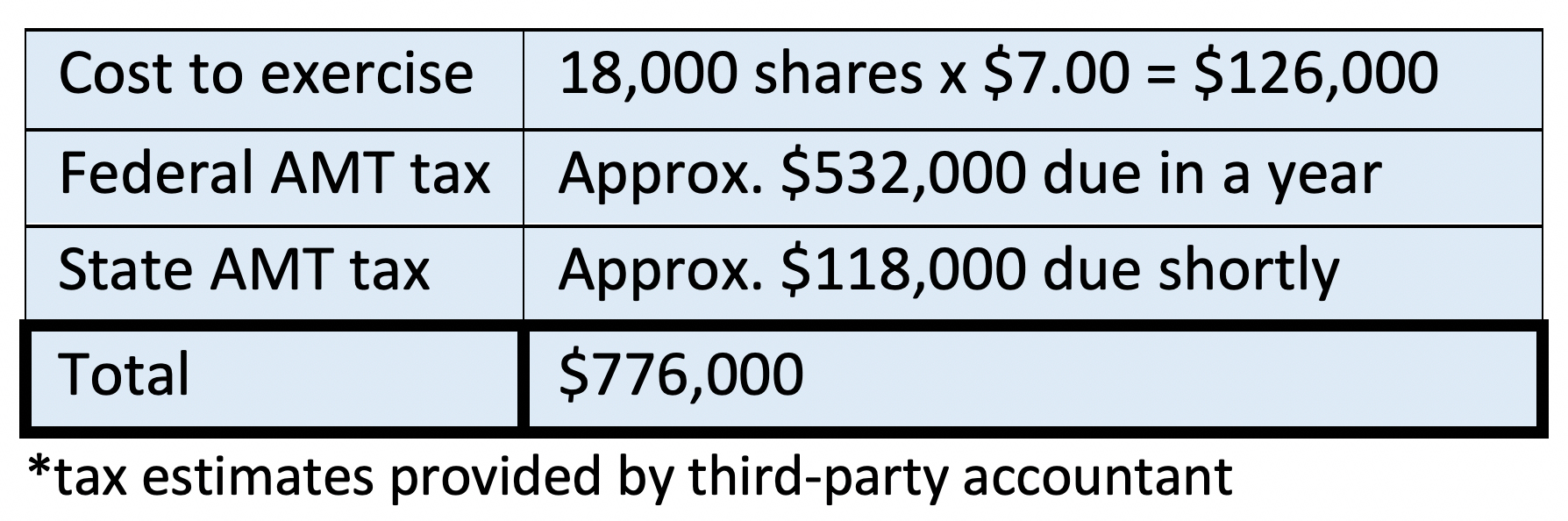

Costs to exercise the options

To exercise the $7.00 ISOs, there were several costs we must consider.

How to Fund These Costs

- John had $250K cash from brokerage account stock sales.

- John owned $675K in vested and soon-to-be-vested RSUs, which after tax netted $385k.

These cash solutions provided $635K in total, which was enough to pay the exercise cost, state tax, and $391K of the $532K federal tax. John did not have any other liquidity, so we considered all options, such as a personal loan, Home Equity Line of Credit, etc. Due to timing and simplicity, the third-party accountant advised John to maintain a $141K tax liability until he eventually sold the exercised ISO’s. This would be approximately a 6-month tax delinquency. According to the accountant, the penalty for not paying a federal tax liability at the time was 0.5%/month, which essentially equated to a 3% loan over the course of 6 months. In addition, there is an annual interest rate on the tax liability that constantly changes, but we are using 4% for the sake of this exercise. Six months of interest would add 2% to the liability.

Remember, we employed this buy and one-year hold strategy for tax efficiency since the client is comfortable holding the stock for one year and we could save approximately 20% in taxes. John was willing to accept the risk of the stock possibly declining in value during that period. Being optimistic about the prospects of the stock, he also recognized that any stock growth during that one-year period was a bonus.

The Result

John followed our recommendations. He unlocked over $3,000,000 in proceeds given the stock’s growth during the 1-year hold period. This advanced planning saved him over $500,000 in taxes.

Our work does not end there – as financial planning is an on-going, dynamic process. John owned other ISOs and RSUs, which he wanted to continue to own for the longer-term should SpaceX stock continue to rise. We agreed upon a strategy to diversify out of 10% of his remaining SpaceX stock per year. That way, he can participate in the potential growth of the company while also securing a portion of his overall portfolio in diversified investments.

Client B (Jane)

Jane owns 2,600 shares of vested SpaceX ISOs with a grant price of $12.20 along with other smaller lots of ISO’s and RSU’s. SpaceX stock was internally valued at $169/share, equating to a $439,400 total ISO value on the 2,600-share grant. Jane’s goals are to lock in the value of the stock for potential home purchase and other short-term needs.

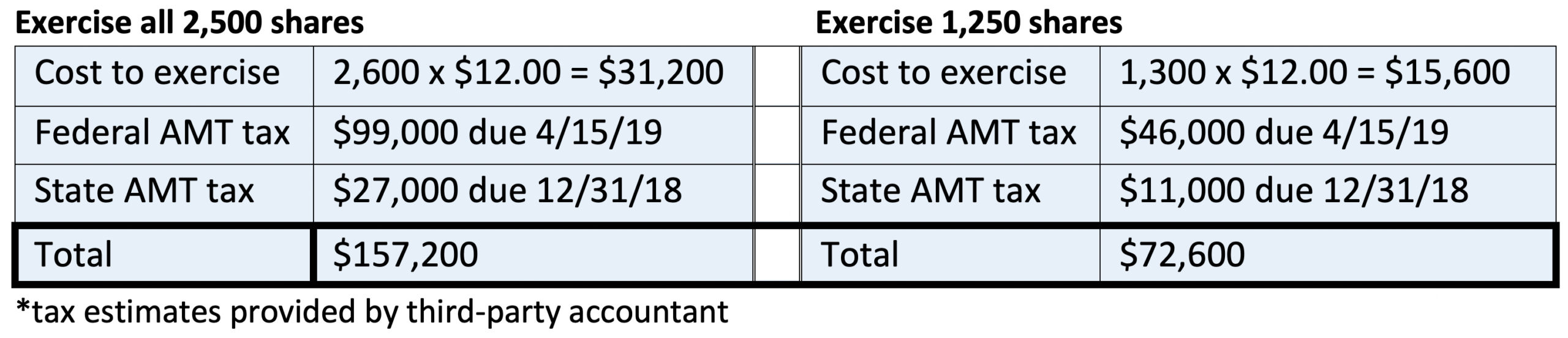

Costs to Exercise the Options

Jane’s situation is challenging as she does not have access to outside cash or assets to help purchase the stock options. She also has limited credit availability. We first analyzed the costs of exercising the whole lot of 2,600 ISOs versus half of the shares.

Due to the cost and lack of liquidity, we recommended exercising half the ISO’s (1,300 shares).

How to Fund These Costs

- Jane will raise $43K of cash by selling vested RSUs that she owns. The sale will result in approximately $5K capital gains tax.

- Jane will spend $9K to exercise a smaller lot of ISOs worth $18K. She will immediately sell the shares to raise $18K cash, while also realizing another approximately $2K in ordinary income tax.

In total, Jane will have raised $61K cash of the $88K needed to fund exercise costs and the subsequent taxes for the funding plan, which leaves a $27K deficit. Like John, Jane will follow the advice of her accountant to maintain a federal tax liability ($27k) until she can sell some SpaceX stock in June 2019 at the lower long-term capital gains rate. According to the accountant, on the $27K liability, she will owe the 0.5%/month penalty plus the 4% annual interest rate for three months. This equates to just under $1,000 in interest and penalty.

Jane has a positive outlook of SpaceX stock, so the strategy of selling half the position not only addresses the short-term liquidity needs, but it allows her to maintain exposure to the potential growth of the company. We recommended continuing this strategy going forward as her additional RSUs continue to vest and become available as a source of funds to exercise more ISOs.

Final Thoughts

Throughout history, corporate executives and their employees have amassed small fortunes from the success of their individual companies. However, wealth creation can often lead to wealth destruction if a plan isn’t eventually put in place. No matter how well you know your industry or company, predicting the future is impossible and unsystematic risk must be mitigated. We as financial planners are experienced in facilitating our clients with these types of difficult decisions. Feel free to reach out to either of us for an initial meeting.

Eric Pritz and Kyle Demshki are both CERTIFIED FINANCIAL PLANNER™ professionals at Signature Estate & Investment Advisors, LLC. They can be reached at (310) 712-2349, epritz@seia.com, or kdemshki@seia.com.

1 Cembalest, Michael, and J.P. Morgan Asset Management. “The Agony & The Ecstasy: The Risks and Rewards of a Concentrated Stock Position.” Eye on the Market, 2014.

3 https://www.investopedia.com/articles/tax/09/restricted-stock-tax.asp

4 https://turbotax.intuit.com/tax-tips/investments-and-taxes/incentive-stock-options/L4azWgfwy

5 Cembalest, Michael, and J.P. Morgan Asset Management. “The Agony & The Ecstasy: The Risks and Rewards of a Concentrated Stock Position.” Eye on the Market, 2014.

6 https://www.fidelity.com/viewpoints/guide-to-diversification

*Although the information has been gathered from sources believed to be reliable, it cannot be guaranteed. Federal tax laws are complex and subject to change. This information is not intended to be a substitute for specific individualized tax or legal advice. Neither Royal Alliance Associates, Inc., nor its registered representatives, offer tax or legal advice. As with all matters of a tax or legal nature, you should consult with your tax or legal counsel for advice.

Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Registered Representatives offer securities through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit seia.com/disclosures.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.