The SEIA Report Q2

Is This Time Different?

By Sam Miller, CFA®, CFP®, CAIA®

Senior Investment Strategist

Just like fashion, art, and cooking, investing is also subject to fads and styles that come in and out of favor. Whether it’s dotcom stocks or cannabis startups or cryptocurrencies, it’s simply human nature to become enamored with the shiny new things that everyone’s buzzing about.

One of the trendiest investments in recent years has been “Big Tech” – a very select group of the largest technology and communications companies that includes some combination of Facebook, Amazon (officially a consumer discretionary stock), Netflix, Microsoft, Apple, and Google and which is referred to by various different acronyms (e.g., FANG, FAAMG, FANMAG) depending on whichever companies happen to be shining the brightest most recently. In most instances, we advocate steering clear of investment fads. But unlike other passing crazes, the adoration heaped on this short list of companies has been well deserved as collectively they have demonstrated truly remarkable innovation, scale, and profitability.

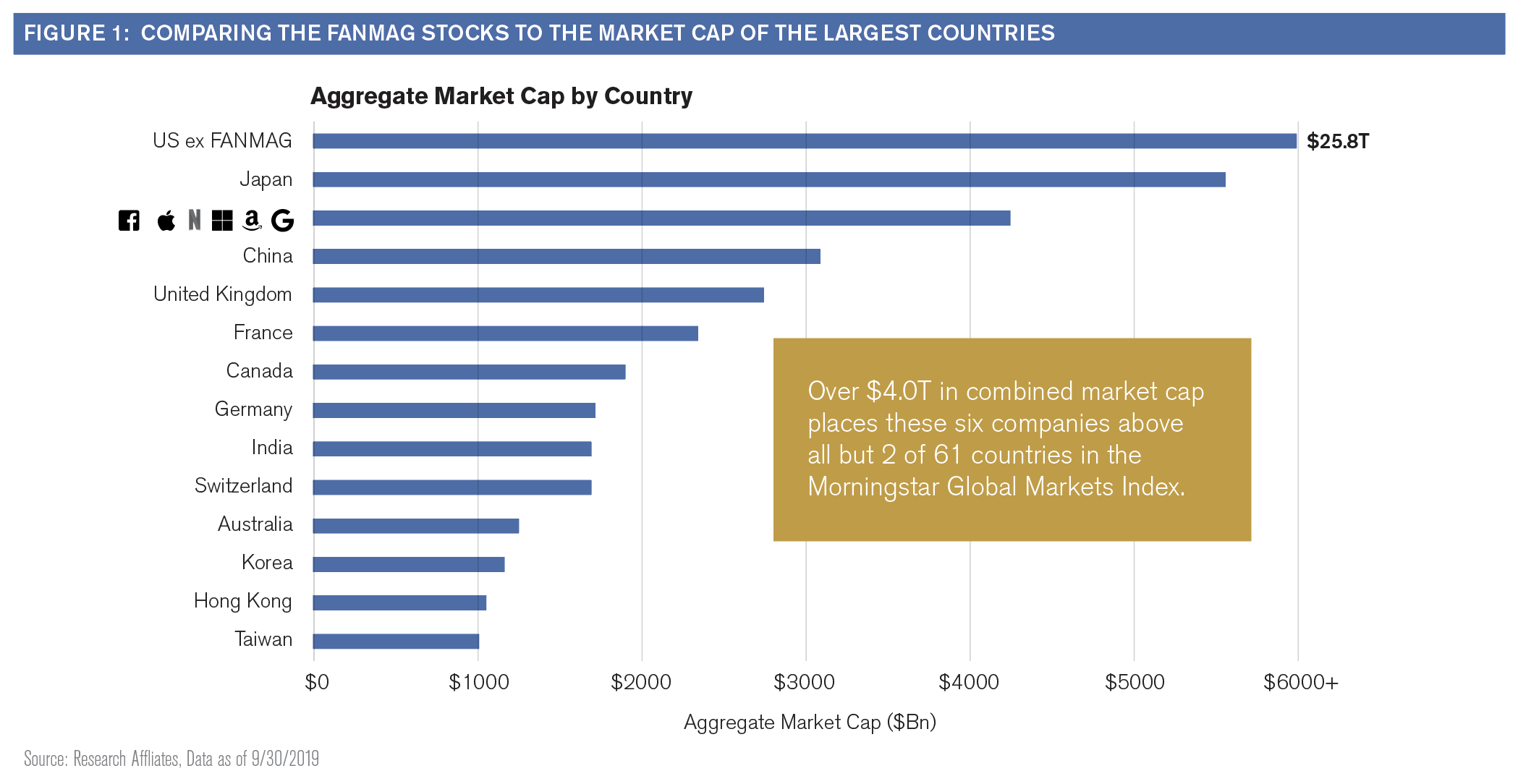

As a result, the stocks of these companies have handily beaten every other category, both in the raging bull market of the last decade as well as in the pandemic-fueled sell-off and recovery of 2020. Unlike other market cycles, where the outperformers on the way up often underperformed on the way down, Big Tech has bucked this trend. With the coronavirus improving the long-term prospects of businesses that can not only operate but thrive virtually – with less reliance on traditional workforces and brick-and-mortar stores – the rich have become richer. The end result? Now this small basket of companies is bigger than the market capitalization of most countries (see below).

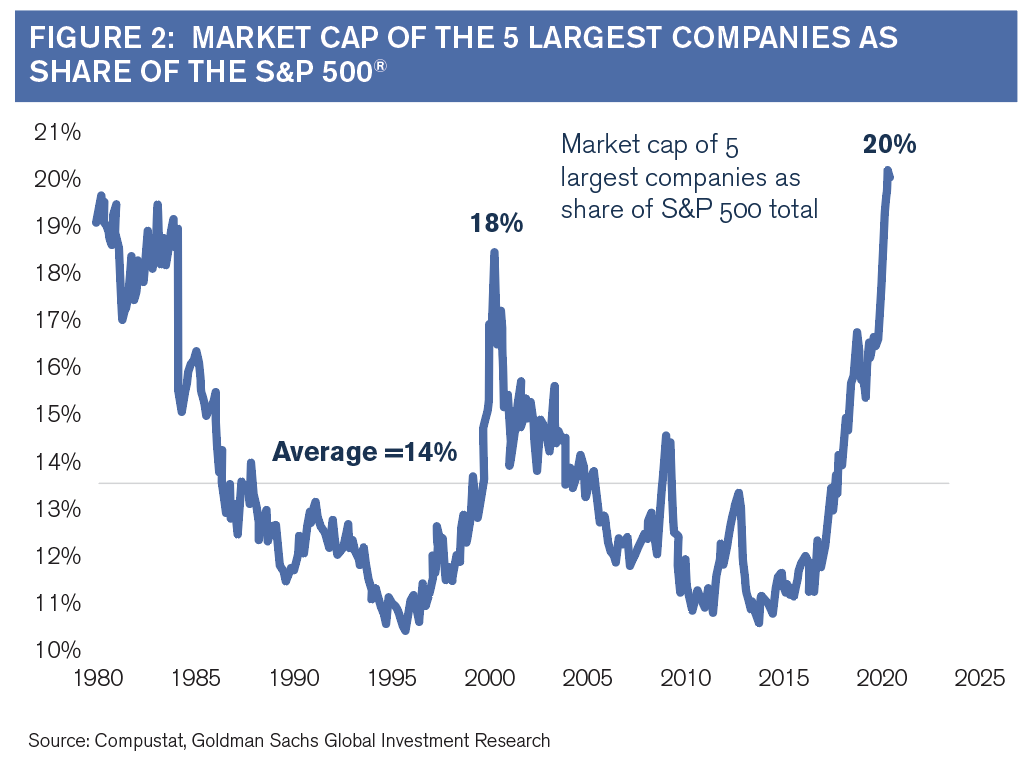

But this outperformance has also generated more risk in the form of narrower breadth and the greatest market concentration since the dotcom boom of the late 1990s (Figure 2). The market’s prospects are currently riding on a far smaller list of companies than is typically the case. In fact, over the last 30 years, no two companies had ever EACH comprised more than 5% of the S&P 500® index. As of the time of this writing, Microsoft and Apple both do. Since the COVID-19 drawdown in March, Facebook, Amazon, Microsoft and Netflix have all led the market rally (achieving new all-time highs in the process), with the other FANMAG names

not far behind.

Why You Shouldn’t Put All Your Eggs in the Big Tech Basket

Certainly, tech stocks have been one of the few bright spots in an otherwise awful crisis. And it’s feasible that their outperformance might continue further into the future. But if market history has taught us anything, it’s that at some point performance will reverse as expectations begin to exceed reality. The technology sector in general (and FANMAG stocks in particular) will continue to be an important building block for most portfolios; yet we caution investors not to extrapolate the last few years’ worth of performance into the future for several reasons:

1. There are upper bounds to growth

Since 2014, the market cap of Facebook, Amazon, Apple, Microsoft, and Google grew at an annualized rate of 21.6%, while the S&P 500 grew at 7.7%1. If these growth rates were to continue, in seven years these five stocks would represent HALF the index. Six years later, they would represent almost the entire index. From a purely mathematical perspective, this can’t happen. The larger these companies become, the harder it will be to sustain the same astronomical growth going forward.

2. History offers some clues as to what happens next

Narrow breadth like we’re experiencing can last for an extended period of time, but past episodes have always reversed. With a median duration lasting of three months, and the longest lasting 27 months from 1998-20002, these episodes have always ended in one of two ways: (1) The market leaders experience a large drawdown because fundamentals can’t catch up to elevated valuations and investor crowding; or (2) an improving economic outlook and strengthening sentiment help the laggards catch up to the leaders, causing relative underperformance by the leaders. In either case, investors would be wise to own other asset classes that will benefit from such scenarios.

3. It’s not uncommon for a small number of stocks to drive market performance, but history tells us that it’s extremely tough to identify those stocks in advance and they don’t stay on top for long.

It’s actually quite common for a smaller subset of stocks to drive a sizable portion of the overall market return. However, if we look at the top 10% of stocks by performance each year since 1994, on average less than 20% of that group continued to rank in the top 10% the following year3. Just as with asset classes, research shows there’s no reliable way to predict what stocks will be top performers in any given year.

4. Regulatory headwinds

While government officials currently remain focused on fighting COVID-19, one can only assume that the call for antitrust scrutiny will grow louder as the Big Tech names grow bigger and more dominant. Proposals like splitting up Amazon’s web and retail businesses, breaking up Facebook into its constituent parts, curtailing Apple’s power over the app store, or slowing Google’s dominance in online advertising will continue to be discussed and eventually may begin to take shape. Presidential candidate Biden has specifically criticized Facebook and Amazon in the past, and this discussion is sure to take center stage as the election approaches.

While Big Tech will certainly continue to play an important role in driving performance, headwinds for these companies are likely to increase. Diversified investors would be wise to stick with their investment plan, rebalance back to your targets, and continue to allocate to “out of favor” asset classes like Value, Small Cap, and International as we believe patience will be rewarded.

[1] Bloomberg

[2] Goldman Sachs

[3] Dimensional Fund Advisors

This article is for informational purposes only and is not intended as individual investment advice or as a recommendation of any particular security, strategy, or investment product. Investing involves risk including the potential loss of principal. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies involve investment risk. Past performance is no guarantee of future results. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc. ID # 052920 – 10303950 – 21033101

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.