The SEIA Report Q4

By Deron McCoy, CFA®, CFP®, CAIA®, AIF®

Chief Investment Officer

2023 – Changing Landscape Yet Again

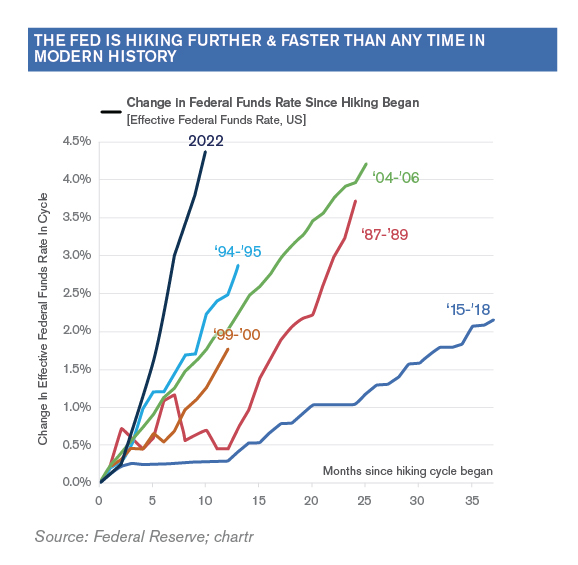

We said it earlier this year. “Inflation changes everything.” Why? Well, to put it succinctly, the 40-year high in inflation we experienced in 2022 forced a major change in the investment landscape. How? The Federal Reserve’s congressional mandate is to maintain price stability; so when prices get out of hand (i.e. inflation) they must act. But because they were late to the game in addressing runaway inflation – believe it or not, the Fed was still stimulating the economy with both a Quantitative Easing program as well as maintaining a zero-interest rate policy as late as March – the Fed needed to play catch up. In monetary policy parlance, catching up translated into the fastest rate hiking cycle in forty years; moving rates from 0% to 4% in a mere nine months.

The shrapnel of this monumental change in interest rates resulted in major ‘Pain on Wall Street’ with two hurricane selloffs – one in the bond market and the other in the stock market. Now as we head towards the New Year, higher interest rates are starting to dampen economic growth. While at first higher rates dampened activity in industries dependent on loans (housing, etc.), it now appears that the weakness is spreading to the larger economy. Should investors brace for another hurricane—this time in the U.S. Economy?

Perhaps. But it’s not what you think.

Cross Correlation And Lead-Lag Effects

In contrast to the pain on Wall Street this year, a weaker economy next year could be characterized as ‘Pain on Main Street’ in the form of lower home prices and higher unemployment. But for investors, this is not necessarily a bad thing.

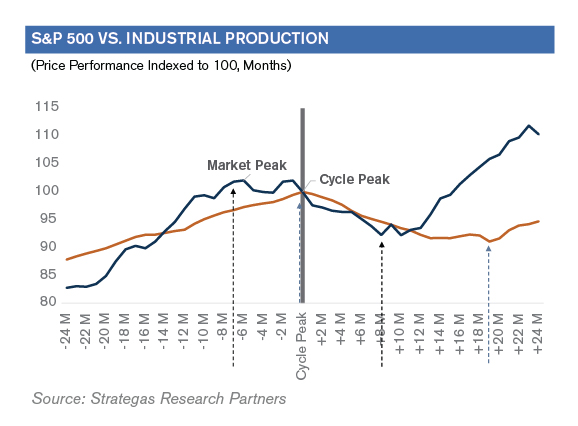

How can this be true? Just think back to the last prolonged bear market and recession during the Great Financial Crisis. We all remember the major events, but few of us recall their precise sequence:

- 2008 served as the epicenter of ‘Pain on Wall Street’; with the collapse of Bear Stearns, Washington Mutual, Countrywide, Lehman Brothers and most of AIG.

- Stocks cratered, and ultimately bottomed in March of 2009.

- Meanwhile the malls and restaurants (Main Street) were still humming along.

- It took some time for Main Street to finally feel the impact in the form of empty malls, lower home prices and higher unemployment.

- By the time Main Street eventually stabilized, stocks (Wall Street) were already up triple digits!

Astute investors will notice that while the two cycles were related and correlated, one led while the other significantly lagged. In other words, stocks predicted the recession—not the other way around. We may very well see the same setup occur in this current cycle.

Another Change In The Investment Landscape

In short, if history holds and the patterns of prior cycles again repeat, a potentially weaker economy next year does not necessarily translate to another weak year in capital markets. Furthermore, investors can take solace in the fact that the investment landscape for 2023 is also changing. Changing already? Yes! And this time it’s for the better.

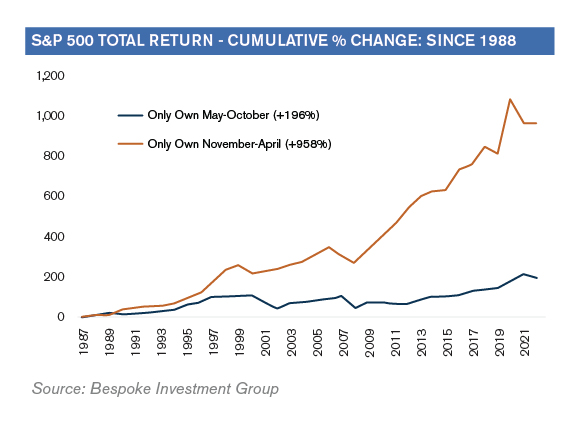

Seasonals

Historically, the bulk of annual investment gains tend to occur over the coming six months.

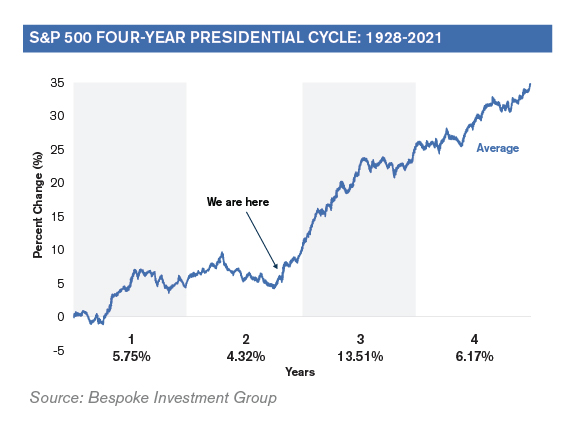

Presidential Cycle

In every single year following mid-term elections, stocks have not only posted gains, but the outsized returns during this period have dwarfed all others.

Political Makeup

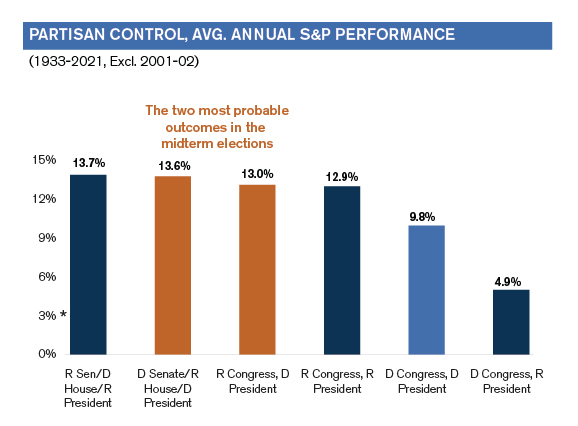

Speaking of mid-term elections, the new division of power in Washington (Democrat President, Democrat Senate, and Republican House) historically has not only favored investors but posted the largest returns of any other combination.

Corporate Earnings

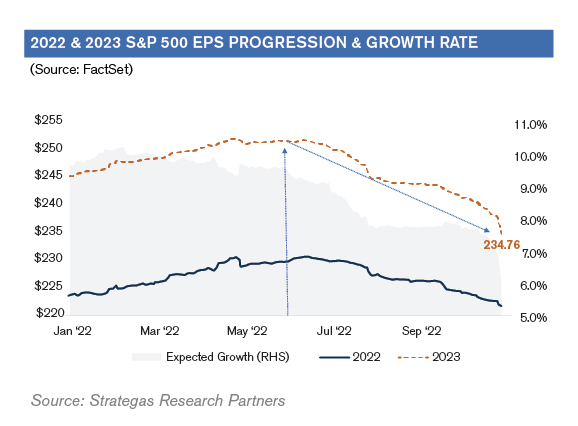

True, not everything can be bullish. In fact, the projections for 2023 corporate earnings (EPS) have been revised almost 10% lower since last June. It makes sense, considering the projected economic slowdown. But because stocks trade on expectations, this might actually prove to be good news. With the bar now set materially lower, it should be far easier for U.S. companies to meet or exceed expectations. Normally, a move lower in EPS projections (bearish news) should have a corresponding move lower in stock prices. But stocks have hung in there since June—perhaps that’s a sign!

Interest Rates

The expectation for interest rates have also moved higher since June – with Jerome Powell now saying that rates will need to be hiked above 5% (that number was in the 3’s back in June). Higher interest rates are bad for stocks, right? Normally yes but once again, stocks have managed to hang in there.

Inflation

Coming full circle, let’s revisit inflation. In mid-November a more benign inflation number came out; suggesting that the tighter monetary policy is finally starting to have an impact. Is the 7.70% October CPI print (released in November) still too high? Yes. But it’s the month-over-month figure (0.3%) that’s most important. Why? Because inflation is just math—an annual year-over-year tally of prices. When we post a lower number next month, a higher number from 2021 falls off. If we can just keep a 0.3% month-over-month figure through April, the math will automatically bring inflation down to under 5%. With expectations for future rate hikes stalling out around 5%, we may finally be at a point of positive real rates by mid-Spring. The landscape is changing—there’s no need for the Fed to raise rates another 4% next year – let alone increase rates beyond current expectations. There’s light at the end of the tunnel!

Time To Change?

Last year, we cautioned that a changing landscape would require corresponding changes to your portfolio—at least at the margin. If we do get a permanent break in inflation, we can expect stable interest rates. If material weakness in the economy ensues, we might even see lower interest rates. Both potential outcomes suggest that Fixed Income won’t suffer the same fate next year as it did throughout 2022. And now, with sizeable yields, longer duration bonds might be attractive – something we haven’t been able to say in years.

What else? If we get a break in rates, we may see a break in the strength (and a possible reversal) of the U.S. Dollar. What does that mean? Foreign currencies would appreciate (perhaps take your European trip sooner than later). But as the Pound, Euro, and the Yen strengthen, any assets denominated in those currencies would appreciate as well – providing a tailwind to international stocks. International stock valuations are also currently quite cheap compared to their U.S. counterparts. And if we get a hoped for cease-fire in Ukraine, then perhaps economies and corporate earnings would explode in a post-war boom. Higher earnings, higher valuations, and domiciled in an appreciating currency? A trifecta of tailwinds for overseas stocks – something else we haven’t been able to say for quite some time.

We will be on high alert throughout the coming year to try and gauge the severity of any potential slowdown. While current data suggests a 2023 recession, perhaps the stock market has already sniffed it out. And besides, there’s never been a recession in the third year of a president’s term – so why should 2023 be any different? It’s not like the last few years have been historic or anything?!?

Thank You And Happy New Year

Thank you for the tremendous trust you’ve placed in SEIA during this tumultuous last year. We’ve been calling it hurricane season with two named storms (Hurricane Stocks and Hurricane Bonds) behind us, but with one potential storm (Hurricane Economy) still on the horizon. But as with all weather patterns, this too shall pass. Why? Because investment landscapes change. Rewind 100+ years ago to a time where a pandemic gripped the country, only to be followed by high inflation, a depression and a stock market rout. Sound familiar? Yet history remembers the ‘Roaring 20s’ for what happened next. Make sure you have a sound financial plan. Don’t over-react and let the landscape of the last few years dictate your plan for the rest of the decade. We still have 7 years left in the decade. Perhaps the Roaring 2020s are still to come.

Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. The information contained herein is the opinion of SEIA and is subject to change at any time. It is not intended as tax, legal or financial advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek such advice from your professional tax, legal or financial advisor. The content is derived from sources believed to be accurate but not guaranteed to be. For a complete listing of sources please contact SEIA. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is not indicative of future results. Every investment program has the potential for loss as well as gain. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses. For details on the professional designations displayed herein, including descriptions, minimum requirements and ongoing education requirements, please visit www.seia.com/disclosures. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, 310-712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.