What do rising rates mean for equities?

By Josh Woodard, CFA®

Research Analyst

Markets have been volatile to start the year, as investors digest a significant change in tone from the Federal Reserve. Inflation has taken the center stage for 2022. With the Fed raising rates for the first time in 3 years, Jerome Powell and members of the Fed have been more hawkish regarding monetary policy. Recently, Powell noted that ”We will take the necessary steps to ensure a return to price stability”—a different tone from his previous view of inflation being “transitory.” In response, markets have shifted to price in a more aggressive fed for the next year. Fed officials have signaled that the Fed Funds rate could be 2% by year-end.

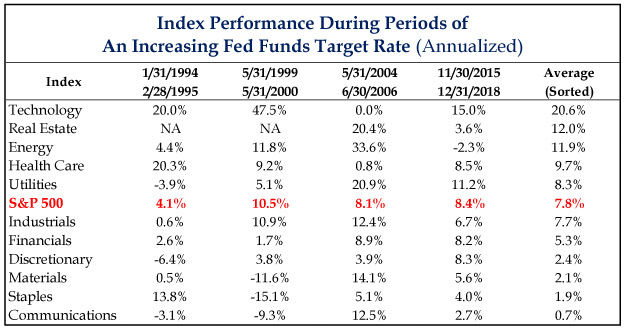

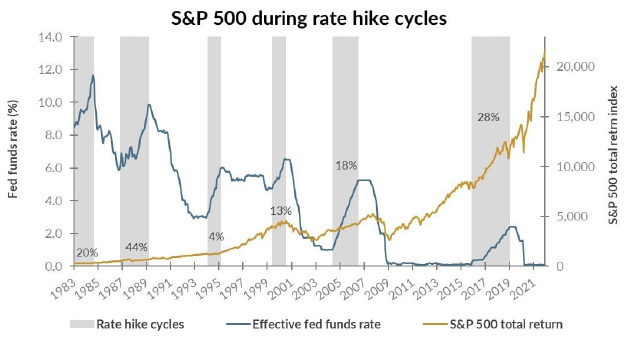

Despite the change in tone, historically, the Fed raising rates has not signaled the end of a bull market. In fact, looking at past cycles, stocks have gone up after the first rate hike of a tightening cycle. On average, going back to 1994, the S&P 500® was up 7.8% per year during each cycle.

Source: S&P 500 Sectors, Strategas

Typically, cycles end when the Fed makes a policy mistake by over-tightening into a slowing economy. An ideal scenario for markets, on the other hand, is when the Fed takes a slow, measured, and methodical approach to gradually raise rates over time.

Looking ahead

Current market conditions (combined with rising interest rates) could lead to a bifurcation of equity performance. While history suggests that stocks do well once the Fed begins to tighten, stocks trading at high multiples may underperform compared to stocks trading at lower valuations.

During times of rising rates, investors typically prefer higher-quality stocks with strong cash flows. In a recent article, Gene Balas, Investment Strategist for SEIA, highlighted investment areas that can offer enhanced value in this market.

Despite the volatility, the good news is that markets are forward-looking and have shifted to price in a more aggressive Fed. This means that more investors are prepared for rising rates, thus removing some of the uncertainty surrounding what the Fed may do. Remember, it’s important to not react to what the market has done, but instead anticipate what may happen moving forward.

Percentage figures represent the performance of the S&P 500 total return index over periods where the effective federal fuds rate is rising. As of December 31, 2021. Source: PMFA, FRED, Morningstar

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. Indexes cannot be invested in directly, are unmanaged, and do not incur management fees, costs, and expenses. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit www.seia.com/disclosures.

Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.