2022 Q1 Tailwinds: “Unfixed Income”

By Deron T. McCoy, CFA®, CFP®, CAIA®

Chief Investment Officer

After a year-long hiatus, investors will once again turn their focus back to Washington DC later this year, as Congressional midterm elections loom on the horizon. But right now, attention is also warranted just a few blocks down the street—where the Federal Reserve and Chairman Powell are poised to not only end their emergency pandemic-related bond buying program (Quantitative Easing) but also begin raising interest rates over the coming months. Shortly thereafter, they may even start selling some of their bond holdings (Quantitative Tightening) in an effort to reduce their now massive balance sheet and return to some semblance of normalcy. In short, now that both high unemployment and deflationary fears have reversed trends from the depths of the pandemic, emergency measures are being mothballed.

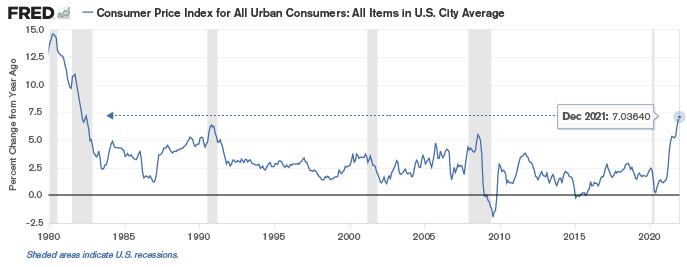

But the depths of the pandemic were comparatively a long time ago! And given that inflation recently breached 7%—the highest level in 30 years—it’s fair to speculate whether emergency monetary policy measures (along with massive stimulus from fiscal policy) may have over-stayed their welcome.

Source: U.S. Bureau of Labor Statistics

Yes, high inflation is here. But it certainly shouldn’t have taken anyone by surprise. It was well telegraphed; we even cautioned investors back in our April 2021 Investment Landscape video, “Overstimulated?” to “anticipate massive inflation numbers in the months and quarters ahead.” You can’t, however, buy or sell inflation in your portfolio. What you can do is position your holdings in assets that are directly affected by that inflation—namely interest rates, as the two tend to move in lock-step.

It’s the reason we urged investors four months earlier (December 2020) to avoid and not chase the returns that Long-Term Treasuries provided in 2020; as losses were more likely to occur in 2021. Long-time readers will recall our depiction of Ernie and Grouch in the Sesame Street game “Which one of these is not like the others?” It was clear a year ago that inflation and longer-term rates were poised to head higher. And now, shorter-term rates are set to move higher as the Fed attempts to reign in today’s high prices.

So here we are. Welcome to 2022!

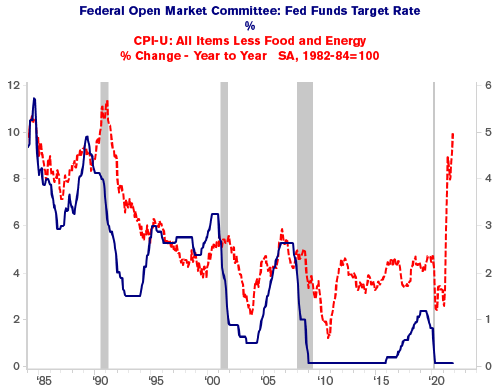

Source: Strategas

Given the current environment, what should you do to reposition? Well, some investors (who ignored our urgings from a year ago) may read current media headlines and rush to liquidate all their fixed income bonds. We actually agree—well kind of. Well not really. Let us explain.

First, let’s agree that liquidating an entire asset class is probably too aggressive. Sure, if interest rates do materially increase then fixed income bonds may get hurt. But if you instead reallocated those proceeds to stocks, you could experience even greater losses—since equities are more volatile than bonds in the first place. And rotating to cash isn’t exactly an elegant option considering the negative real yields that cash currently generates.

Second, fixed income bonds are not a ‘get rich’ asset. They’re a ‘stay rich’ asset that provides a nice ballast to an overall portfolio. If stocks do sell off, not only will the fixed income bonds dampen your portfolio’s volatility, but they can provide you with some dry powder to take advantage of the selloff—by buying low. In fact, that’s the time when real material long-term wealth is created.

Third, by now hopefully you’ve noticed my use of the term ‘fixed income bonds’ ad nauseam; and that’s the real takeaway from this discussion. At times of low and rising interest rates, it’s generally NOT wise for investors to lock in a long fixed-rate return. Think of it like the polar opposite of your mortgage. When you borrow money in an era of high and falling interest rates, you may want an adjustable-rate mortgage, so that your payment drops as interest rates drop. But when mortgage rates are low and starting to rise, you may want to lock in a low rate for an extended period.

When talking about bonds, however, you the investor are the lender rather than the borrower—so the thinking is just the reverse. In times of low and rising rates, you want to invest in (i.e., lend to) a vehicle that has an adjustable coupon. In bond parlance, you want a floating-rate coupon. These ‘unfixed’ income bonds actually do better when interest rates rise—as the coupon ratchets higher when interest rates move higher (investors can take advantage by owning real estate mortgages or corporate loans that are tied to movements in short-term interest rates). It’s the classic example of rearranging and adjusting a portfolio to turn a potential headwind into a massive tailwind. Even though ‘unfixed’ income is preferable, you don’t need to shun ‘fixed-income’ completely. Why? This is where it gets a bit nuanced and potentially confusing (we’ll try our best to explain, but please reach out if you have further questions, comments, or concerns). While the Fed controls short-term rates, the economy controls longer-term rates.

It’s not a stretch to envision a scenario where a surge in Covid negatively affects labor and the supply chain—in turn altering the balance between Supply and Demand, which then continues to put upward pressure on inflation. As a result, the Fed opts to continue its path of hiking short-term interest rates, which in turn cool demand and slow down the overall economy.

But…

…the resulting cooling of the economy causes longer-term interest rates to drop. Thus, short-term rates could potentially move up while longer-term interest rates move down. Sound crazy? Well, it’s happened before—many times.

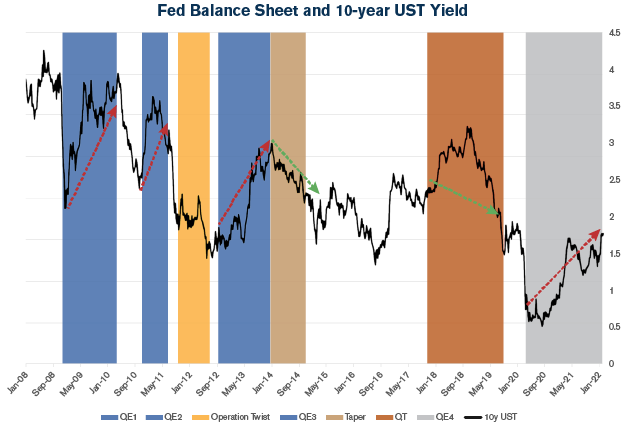

A closer look at the adjacent chart (provided by DoubleLine Capital) details the rise and fall of the 10-year U.S. Treasury Yield in different eras. You can see that in the eras of QE (red arrows), yields actually rose. Conversely, in times of Taper and Tightening (green arrows), yields fell.

Source: DoubleLine Capital

As always, the future is uncertain and unknowable. But at this stage of the business cycle, short-term rates look poised to rise in the near term. Investors would be wise, therefore, to reposition a portion of your bond portfolio to take advantage of this changing investment landscape, and hopefully turn headwinds into tailwinds.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies, involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment; it is a method used to help manage investment risk. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. In general, the bond market is volatile, bond prices rise when interest rates fall and vice versa. This effect is usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. The investor should note that vehicles that invest in lower-rated debt securities (commonly referred to as junk bonds) involve additional risks because of the lower credit quality of the securities in the portfolio. The investor should be aware of the possible higher level of volatility, and increased risk of default. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit seia.com/disclosures.

Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.