The Outlook for Infrastructure

By Sam Miller, CFA®, CFP®, CAIA®

Senior Investment Strategist

As we emerge from the pandemic, it’s important to reflect on the past year and acknowledge the essential role—for better or worse—that government must play in preparing for (and dealing with) similar events in the future. In much the same fashion, infrastructure is another area where government must take the lead.

An increase in federal funding could create millions of jobs, improve the quality of essential services such as water, transportation, and communication, and make the U.S. economy more adaptable to challenges going forward—from climate change to technological disruption.

But, what exactly is the current state of infrastructure in our country? And more topically, what are the prospects for President Biden’s infrastructure agenda?

The state of infrastructure

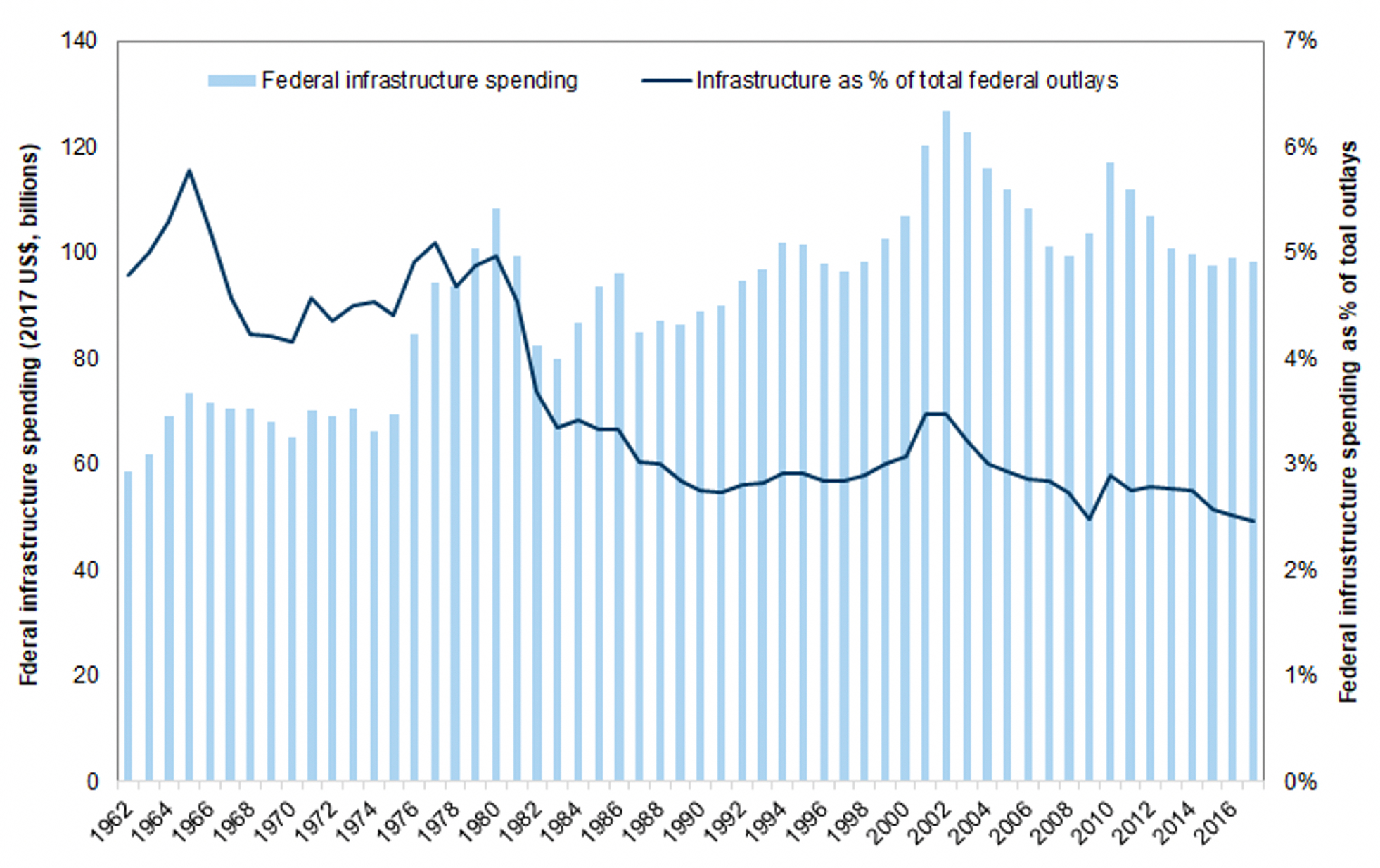

Talking heads in the media often cite our nation’s ‘crumbling infrastructure.’ In reality, there’s some truth to this talking point. Over the last 60 years, federal spending on infrastructure as a percentage of total spending has decreased from 5.8% to 2.5%.[1]

Federal Spending on Infrastructure (1962-2017)

Since 1998, the American Society of Civil Engineers has graded the condition of U.S. infrastructure by category, and attempted to estimate the cost of repairs and needed upgrades. In 2021, the nation received a C- (defined as ‘mediocre and requiring attention’). Categories receiving the lowest marks include dams, levees, roads, storm water, and transit. Ports and rail systems, on the other hand, received the highest marks.

A large percentage of U.S. infrastructure was built in the mid-20th century and simply doesn’t have the capacity or resilience to meet current demand. For example, the average age of our nation’s dams is 57 years. Similarly, most of the electricity grid was constructed in the 1950s and 1960s, and wasn’t engineered to meet today’s demand or sustain the effects of severe weather events.

Looking beyond our borders, the U.S. lags behind other major economies in both infrastructure quality and level of investment—ranking 13th globally as of 2019.[2] Of even greater concern is that in an increasingly internet-dependent economy, we currently rank 27th in information and communication technology adoption.[3]

Of course, infrastructure needs have evolved over time. In the 18th century, rivers and canals were the most important modes of transportation. Those were supplanted by railroads in the 19th century, which in turn gave way to highways and aviation in the 20th century. In the 21st century, however, physical travel has become less critical as 5G and telecommunications take center stage—requiring significant ongoing investment to remain globally competitive.

The American Jobs Plan

Spending on infrastructure is inevitably linked to politics. Most people agree that infrastructure spending is necessary, but there can be great disagreement around the details—which brings us to the proposed American Jobs Plan. The Biden administration introduced this $2.3T spending package back in March. The plan includes a combination of traditional infrastructure spending (for roads, transportation, and other shared public facilities) along with nontraditional infrastructure—projects not historically funded by the federal government or considered within the definition of infrastructure. These include expanding care for the elderly and people with disabilities, producing or retrofitting affordable housing, green initiatives, health insurance affordability, access to community college and more.

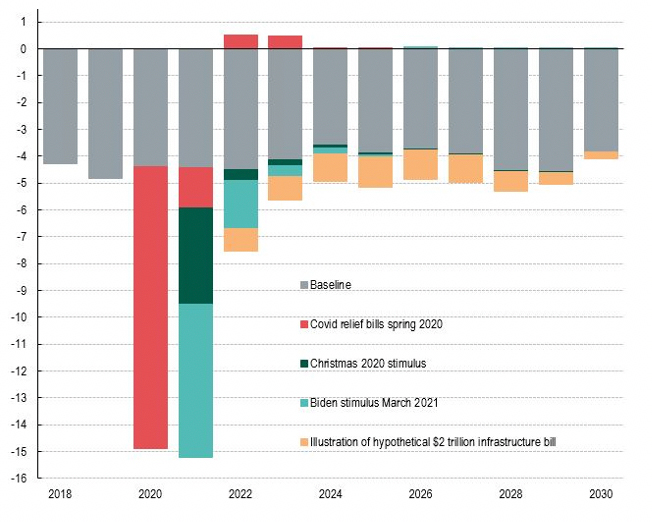

The Biden administration proposed paying for the American Jobs Plan by reversing large parts of the Tax Cuts and Jobs Act implemented during the Trump administration. In summary, the plan would bump up tax rates on corporations and make it more difficult for companies to avoid taxes by going abroad. Unlike other recent stimulus bills where the goal was to boost economic activity as quickly as possible, the proposed infrastructure spending would take place over the course of years rather than months and would extend well beyond Biden’s current term.

Change to US federal budget deficit as a percentage of potential GDP[4]

Negotiations are ongoing between the Biden administration and Senate Republicans. Recently, Republicans countered with an infrastructure proposal of their own carrying a much lower price tag and excluding all of the non-traditional infrastructure items. While we expect negotiations to continue through the summer months and many details to change between now and the passage of any legislation, the bottom line is that Democrats have unified control of government (albeit by a razor thin Senate majority) for the first time since 2010. There’s a good chance they may take advantage of this control while they have it.

As we know, few major proposals ultimately get done without a deadline or a sense of urgency to push the process along and force politicians to compromise. In this case, there are some key dates in late summer or early fall related to when recesses occur and current transportation funding expires.

Winners and losers

In a vacuum, increases in taxes reduce cash flows for corporations, so act as a headwind for stocks on the surface. But, the burden of tax increases will not be equal across companies. For example, pharmaceutical and semiconductor companies have the greatest tax risk from higher taxes on worldwide income. Conversely, companies already paying a high tax rate with most of their revenues generated domestically have the least to lose. This includes companies like railroads, financial exchanges, and apparel. Beyond immediate tax effects, traditional infrastructure companies involved in building materials stand to considerably benefit from increased investment. If we examine the big picture, infrastructure investment should boost the productive capacity of our economy as a whole. We believe over the long term, better prospects for future growth should help to outweigh any increase in corporate taxes.

In summary, there’s a great deal of room for improvement as far as our infrastructure is concerned. Not only do traditional roads and bridges need upgrading, but also technology, as we try to keep our systems safe from cyber-attacks, plan for the future, and try to remain competitive globally. Negotiations will continue to heat up in Washington over the summer months. There will certainly be some modifications along the way. The winners and losers will likely change depending on the ultimate details—so we will continue to closely monitor the situation and manage client portfolios accordingly.

[1] Congressional Budget Office, Goldman Sachs Investment Research

[2] World Economic Forum

[3] World Economic Forum

[4] Congressional Budget Office (CBO) and BNP Paribas

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. The information contained herein was carefully compiled from sources SEIA believes to be reliable, but we cannot warrant or guarantee the accuracy or completeness of the information provided. SEIA is not responsible for the consequences of any decisions or actions taken as a result of the information provided herein. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies involve investment risk; Past performance does not guarantee future results. Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.