THE SEIA REPORT Q4

By Sam Miller , CFA®, CAIA®, Senior Investment Strategist

Gridlock Ahead?

As expected by most political pundits, the 2018 Midterm election saw Democrats win the House with Republicans maintaining the Senate. Despite a reputation for deploying unconventional tactics, President Trump appears to be bound to historical norms in at least one sense: US voters continue to prefer a government with shared power. The end result is a continuation of a trend that we have witnessed many times before: the president’s party lost control of the House in a midterm election, leading to a divided Congress. Traditionally, this results in gridlock as neither party can freely move forward with their legislative agenda.

Further, a Democratic House likely means we’ll see congressional investigations into the Trump administration, leading to sensational headlines and additional political noise. A divided government may result in an increase in policymaking via executive order, potentially escalating trade/tariff fears. One of the few measures with a chance for bipartisan support will involve spending that isn’t coupled with a tax increase, such as an infrastructure bill. All of these events may make for political instability and volatile markets in the short-term, but should have little impact on economic reality longer-term.

What’s Next For Markets?

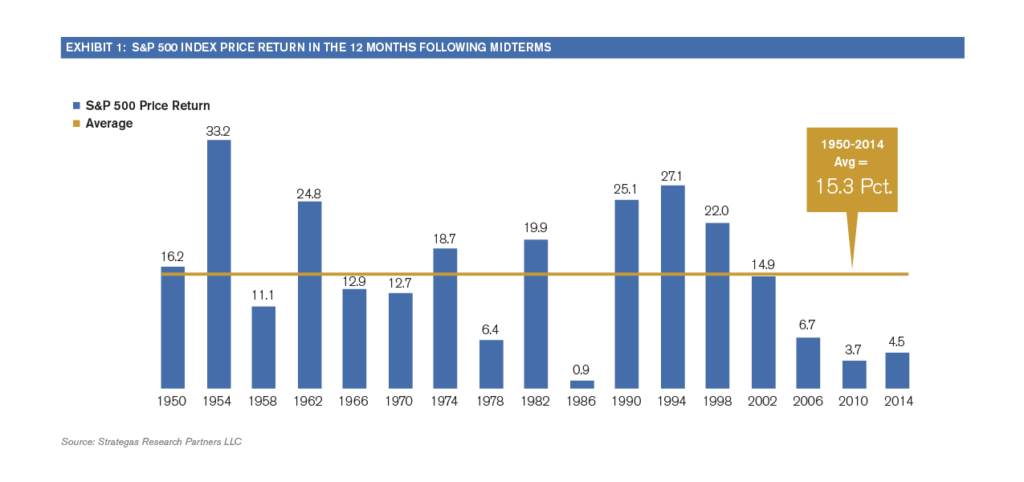

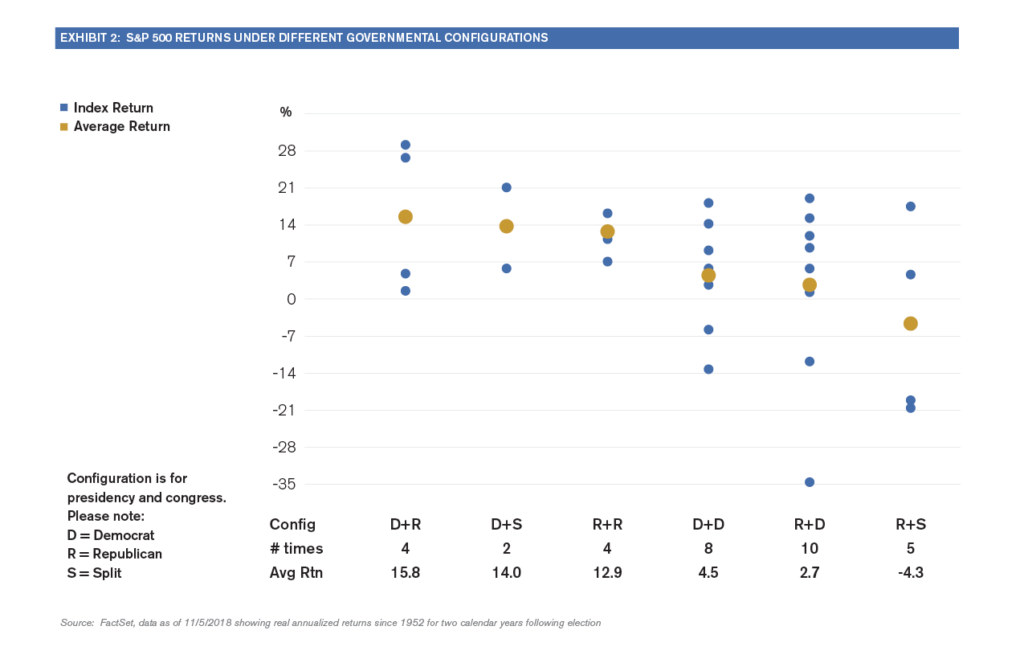

Since investors dislike uncertainty, equity markets typically decline in advance of elections, but have historically performed well in the aftermath once the dust settles. Since 1950, the stock market has not declined in any 12-month period following a mid-term election. The average gain for stocks during that time period has been 15.3% (Exhibit 1). One theory to explain this market activity is that as presidents approach reelection they focus on the economy and try to enact pro-growth policies that are friendly to equity markets, resulting in higher share prices. While that 15.3% average historical return sounds great, the combination of a Republican president and a split Congress has actually resulted in an average annualized return of –4.3% since 1952 (Exhibit 2). Of the possible configurations, this has historically been the worst performing combination.

While it’s interesting to study history, we should be wary of putting too much weight on these figures. After all, the combination of a Republican president and a split Congress has only happened five times since the 1950s. As is the case for each possible governmental combination, broader macro forces at play have had a much greater impact on market returns than the party in power. I believe this will be the case going forward. While the midterm elections will have a large impact on the political agenda for the next two years, in my opinion it is less likely to have a pronounced or lasting impact on markets. US equities continue to react to a tightening phase by the Fed, slowing global growth expectations, and earnings results. Foreign equities react to escalating trade tensions and the health of Europe amidst Brexit. As was the case before midterms, I believe events outside the political arena have a much higher potential to impact markets going forward. Because of this, we continue to advise clients to avoid viewing the world through a red or blue lens.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.