U.S. Debt Ceiling – Noise, or Cause for Action?

By Phillip Argue

Investment Specialist

In January, the total amount of government debt hit the statutory debt limit – with the newly formed Congress having yet to pass a bill to raise the ceiling. Given a split Congress (and thus a potentially lengthy political battle over future government spending), investors are now forced to wrestle with the possible ramifications:

What happens if a compromise isn’t reached? Should I change my portfolio allocation in response to these new risks?

The debt ceiling was first enacted in 1917, when the U.S. entered World War I. By placing a cap on the amount of debt the U.S. Treasury could issue to finance the war effort, Congress sought to limit the nation’s involvement in the global conflict. Since then, Congress has raised the debt ceiling on an almost annual basis; most of the time with little to no media attention.

Now that Republicans have regained control of the House, it sets the stage for a lengthy debate on fiscal spending – with the party hoping to use the debt ceiling as leverage to force reductions in government spending. Last year the government deficit totaled $1.4 trillion.

Even with the debt ceiling being reached, however, the Treasury can still pay its obligations for several months. The Treasury General Account at the Fed, which acts as the checking account for the federal government, has a balance of roughly $490 billion. And Janet Yellen has clearly stated that even without a resolution on the debt ceiling, the government can continue to operate until the first week of June.

It’s also worth noting that in our nation’s nearly 250-year history, the U.S. government has never once defaulted on its debt. So, while political brinksmanship might threaten a default, it remains a highly improbable outcome. No one benefits from a default; especially politicians who hope to be re-elected.

However, if the debt ceiling isn’t raised in time, we very well could experience a temporary government shutdown. The last shutdown occurred in late-2018, when President Trump demanded funding of the border wall before signing any new spending bill. That approximately month-long shutdown caused nearly 800,000 non-essential government employees to be furloughed.

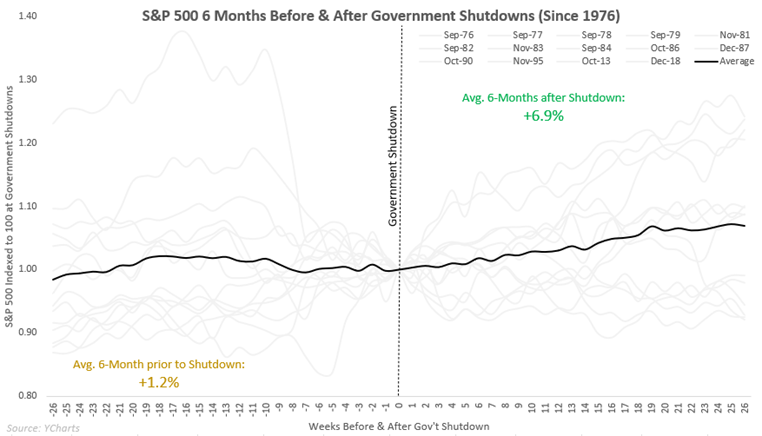

In fact, since 1976 there have been 14 governments shutdowns – most of them lasting only a couple days. As the graph below depicts, on average stocks rose a modest 1.2% during the 6-months prior to a shutdown, then rose a healthy 6.9% during the 6-months after. The wide dispersion of S&P 500® returns leading up to and following each shutdown are particularly noteworthy – suggesting that there are many other factors influencing stock prices.

We believe investors would be well served to keep the current debt ceiling debate in context. While it’s certainly a potential market factor; it’s far from the only one. Rather than politics, it’s our contention that the outlook for corporate earnings, economic growth, and monetary policy will have a significantly greater influence on the performance of financial markets. While we all may be subjected to watching this political drama play out over the coming months, there’s no reason to believe it should warrant any major changes to your portfolio. In the meantime, however, if you have specific questions or concerns regarding the debt ceiling and its potential impact on your current investment strategy, please don’t hesitate to talk with your SEIA advisor.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies, involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit seia.com/disclosures. Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.